Introduction

In a world troubled by inflation and a dollar that is programmed to debase, bitcoin is emerging as a revolutionary savings asset. Bitcoin’s distinct features make it an ideal store of value, offering an escape from the financial system we have today where the value of money erodes over time. In this article, we will explore why more and more people are realizing that Bitcoin's characteristics make it the best choice for safeguarding wealth and providing an honest ledger system.

The Inflation Problem

During the pandemic, central bankers and government bureaucrats attempted to calm the public by indicating inflation would be “transitory” in nature. Officials misled us all by implying that inflation would be short-lived due mainly to supply-chain bottlenecks.

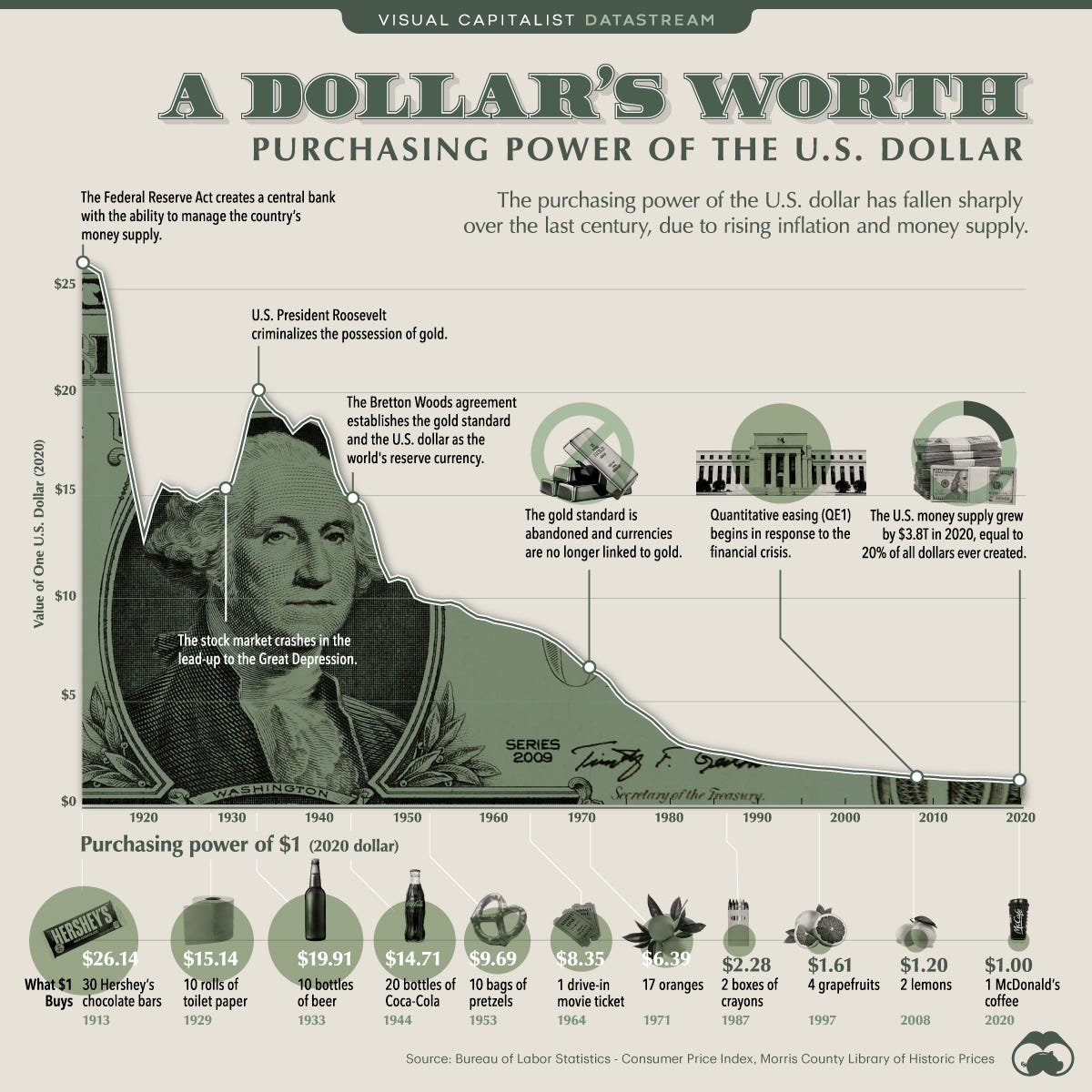

Are assets like real estate and equities really going up in value? Or is the dollar not buying as much?

Demand exceeding supply is not the only contributor to inflation. Increased money supply is another factor. When more money is printed into circulation, each dollar isn’t worth as much. Since 2020, the US dollar has lost purchasing power very quickly, a repercussion of government stimulus that pumped trillions into the economy.

The Federal Reserve’s target of 2% inflation seems so difficult to achieve that they had to change the methodology for which the Consumer Price Index (CPI) is calculated at the beginning of 2023. Manipulated numbers and a distracted populace make for a Federal Reserve and Congress that remain mostly unchecked.

Image Credit: Visual Capitalist

Regardless of the last three years, by the Rule of 72, a constant 2% inflation rate would see the dollar lose half of its purchasing power roughly every 36 years. (Seventy-two divided by 2 equals 36.)

It is no wonder that people are headed for the exits.

New Safehaven

Since the end of World War II, the dollar has served as likely the greatest medium of exchange the world has ever seen. Generally speaking, almost everyone knows what a dollar is worth at any given moment. Sovereign and corporate debt obligations are denominated in dollars and repayment is expected in dollars as well.

Thus, the dollar is relatively stable in the short term, but it has proven to be extremely volatile in the long term.

In contrast, bitcoin is extremely volatile in the short term but is more stable in the long run.

Bitcoin's scarcity is at the core of its appeal as a savings asset. Unlike the dollar and other fiat currencies that are subject to inflationary pressures caused by excessive money printing, Bitcoin's supply is fixed and capped at 21 million coins. This limitation ensures that its value cannot be diluted or manipulated by any central authority, making it a powerful hedge against the depreciating purchasing power of traditional currencies.

Decentralization

Like the Internet before it, bitcoin is operated in a distributed fashion. The Internet is made up of servers and personal devices serving data and interacting on the network all over the world (and even satellites in space).

“The truth is no online database will replace your daily newspaper, no CD-ROM can take the place of a competent teacher and no computer network will change the way government works.” Clifford Stoll, Newsweek, Feb 27, 1995

Bitcoin in self-custody allows owners of bitcoin to have direct control over their savings, eliminating the need for a third party to oversee or manage their wealth. This autonomy provides peace of mind and shields people from the risks of censorship, bank failures, or governmental intervention.

Transparent and Honest Ledger

Bitcoin's blockchain (timechain) technology ensures a transparent and incorruptible ledger of all transactions. Every transaction is permanently recorded on the timechain, providing an honest and verifiable account of the asset's history. This transparency fosters trust and confidence in the system, enabling savers to store their extra wealth with certainty and security.

Long-Term Growth

Bitcoin's history of price volatility may deter some, but the market has matured significantly, leading to reduced fluctuations over time. As a savings asset, it offers potential for long-term growth due to its fixed supply and increasing global acceptance. Savers can benefit from patiently holding onto bitcoin, accumulating wealth as its value appreciates steadily versus all other assets.

A Borderless Asset

Bitcoin is not limited by geographical boundaries, enabling savers to store and transfer wealth effortlessly across the world. Traditional savings often face challenges when it comes to international transactions, with currency exchange rates and transfer fees eating into the overall value. Bitcoin's borderless nature eliminates such barriers, making it an ideal asset for diversifying savings globally.

“To the victor belong the spoils of the enemy.” William L. Marcy

Take for example the recent Russia-Ukraine conflict. As you may know, people often flee war-torn countries and become refugees in neighboring countries. If you self-custody bitcoin in your head, you can travel and not risk search and seizure by enemy combatants or neighboring border guards. As long you can memorize a short set of words, your life savings remains yours and can be used in the future.

Conclusion

Bitcoin's unique characteristics position it as the ultimate savings asset in an inflationary and debt-ridden world. Its limited supply, decentralized nature, honest ledger, absence of intermediaries, long-term growth potential, and borderless attributes make it a compelling choice for safeguarding wealth.

Embracing Bitcoin as a savings tool allows people to break free from the failures of governments and central banks and take control of their financial futures. As with any new technology, prudence and informed decision-making are crucial, but the potential benefits of adopting Bitcoin as a savings asset are undeniably significant.

Published at Bitcoin Block Height 800,665